What is the 504 loan program?

The CDC/504 Loan Program provides long-term, fixed rate financing of up to $5 million for major fixed assets that promote business growth and job creation.

504 loans are available through Certified Development Companies (CDCs), SBA's community-based partners who regulate nonprofits and promote economic development within their communities. CDCs are certified and regulated by the SBA.

Am I eligible?

To be eligible for a 504 Loan, your business must:

- Operate as a for-profit company in the United States or its possessions

- Have a tangible net worth of less than $15 million

- Have an average net income of less than $5 million after federal income taxes for the two years preceding your application

Other general eligibility standards include falling within SBA size guidelines, having qualified management expertise, a feasible business plan, good character and the ability to repay the loan.

Loans cannot be made to businesses engaged in nonprofit, passive, or speculative activities. For additional information on eligibility criteria and loan application requirements, small businesses and lenders are encouraged to contact a Certified Development Company in their area.

How do I use a 504 loan?

A 504 loan can be used for a range of assets that promote business growth and job creation. These include the purchase or construction of:

- Existing buildings or land

- New facilities

- Long-term machinery and equipment

Or the improvement or modernization of:

- Land, streets, utilities, parking lots and landscaping

- Existing facilities

A 504 loan cannot be used for:

- Working capital or inventory

- Consolidating, repaying or refinancing debt

- Speculation or investment in rental real estate

What do I need to apply?

504 loans are available exclusively through Certified Development Companies (CDCs). First, find a CDC in your area to ensure you are dealing with a qualified lender.

Then begin to prepare and assemble your 504 loan authorization package, using our 504 Authorization File Library to identify the documentation you will need to apply for your 504 CDC loan.

How do I pay back my 504 loan?

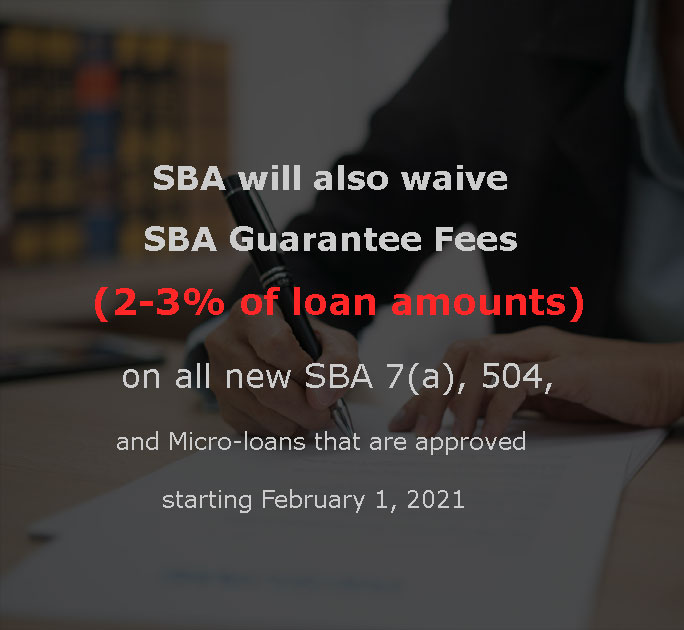

Repayment Terms, Interest Rates, and Fees

Loan repayment terms vary according to several factors:

Repayment terms |

|

Interest rates |

|

Apply Now