What is a microloan?

The microloan program provides loans up to $50,000 to help small businesses and certain not-for-profit childcare centers start up and expand. The average microloan is about $13,000.

The SBA provides funds to specially designated intermediary lenders, which are nonprofit community-based organizations with experience in lending as well as management and technical assistance. These intermediaries administer the Microloan program for eligible borrowers.

Am I eligible?

Each intermediary lender has its own lending and credit requirements. Generally, intermediaries require some type of collateral as well as the personal guarantee of the business owner.

How do I use a microloan?

Microloans can be used for a variety of purposes that help small businesses expand. Use them when you need under $50,000 to rebuild, re-open, repair, enhance, or improve your small business.

Examples include:

- Working capital

- Inventory

- Supplies

- Furniture

- Fixtures

- Machinery

- Equipment

Proceeds from an SBA microloan cannot be used to pay existing debts or to purchase real estate.

What do I need to apply?

Microloans are available through certain nonprofit, community-based organizations that are experienced in lending and business management assistance. Individual requirements will vary.

To apply for a Microloan, work with an SBA-approved intermediary in your area. SBA-approved lenders make all credit decisions and set all terms for your microloan. To find an authorized microlender near you, contact your local SBA District Office.

How do I pay back my microloan?

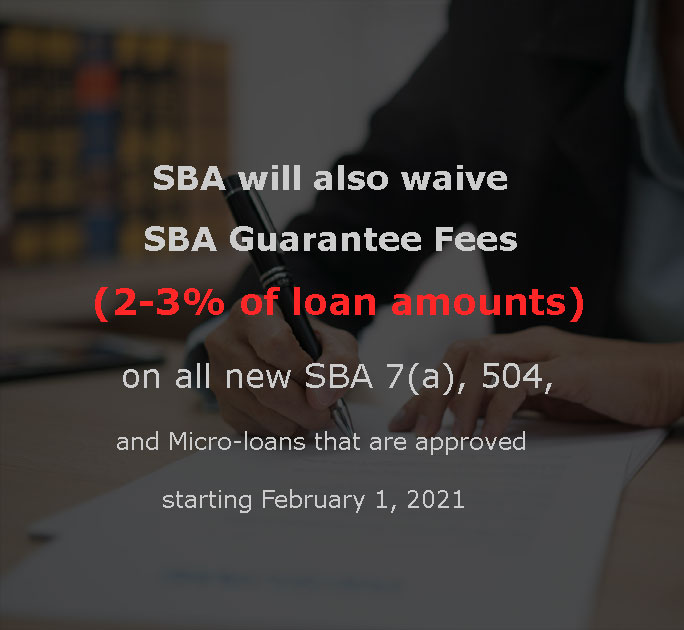

Repayment Terms, Interest Rates, and Fees

Loan repayment terms vary according to several factors:

Repayment terms |

|

Interest rates |

|

Apply Now